Most Americans realize that the federal government is drowning in debt and that inflation is out of control. But very few Americans can coherently explain where money comes from or how our financial system actually works. For decades, bankers that we do not elect have controlled America’s currency, have run our economy into the ground, and have driven the U.S. government to the brink of bankruptcy. The Federal Reserve is an institution that was designed to drain wealth from U.S. taxpayers and transfer it to the global elite. Have you ever wondered why a sovereign nation such as the United States has to borrow United States dollars from anyone? Have you ever wondered why a sovereign nation such as the United States does not even issue its own currency? Have you ever wondered why we allow a group of unelected private bankers to run our economy?

Those are some very important questions. Hopefully what you are about to read will open the eyes of many. The truth is that our financial system is centrally-controlled and centrally-managed by a group of banking oligarchs who oversee a constantly expanding debt spiral which could come crashing down at any time. If the American people truly understood how our system works, they would be protesting in the streets right now. The following are 11 reasons why the Federal Reserve is bad…

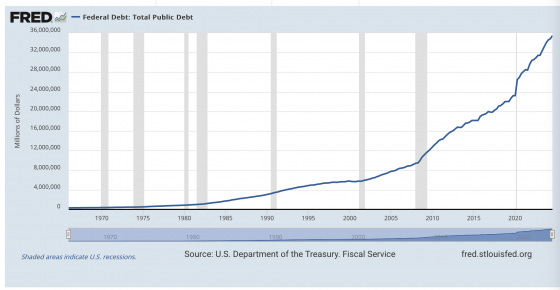

1 – The Federal Reserve was created as a way to enslave the U.S. government. In fact, the Federal Reserve system literally could not function without U.S. Treasury bonds. Government debt is at the very core of the system, and our federal government is now trapped in a debt spiral from which it can never possibly escape because the system is operating exactly as it was designed. Our national debt has been rising at an exponential rate, and that will continue to be the case until either the current system collapses or we adopt an entirely new system.

2 – The individual Federal Reserve Banks are not “federal” at all. In fact, on the official website of the Federal Reserve Bank of St. Louis, it is openly admitted that Federal Reserve Banks “are not a part of the federal government” and that private banks “hold stock in the Federal Reserve Banks and earn dividends”…

The Federal Reserve Banks are not a part of the federal government, but they exist because of an act of Congress. Their purpose is to serve the public. So is the Fed private or public?

The answer is both. While the Board of Governors is an independent government agency, the Federal Reserve Banks are set up like private corporations. Member banks hold stock in the Federal Reserve Banks and earn dividends.

3 – Why does the Federal Reserve issue our currency? The U.S. Constitution explicitly gives Congress the power to issue our currency…

[The Congress shall have Power . . . ] To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; . . .

4 – The Federal Reserve creates money out of thin air. I asked Google AI about this, and this is what I was told…

Yes, the Federal Reserve (Fed) creates money out of thin air by increasing the money supply. This process is called “creating money out of thin air” because it involves adding funds to the economy without printing currency.

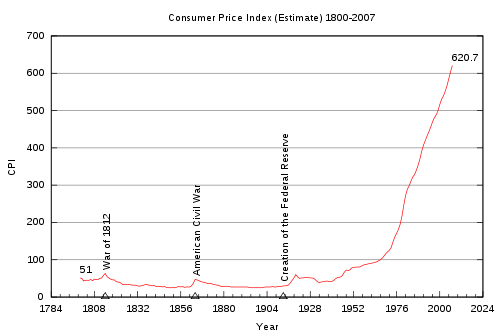

5 – The Federal Reserve devalues our currency. Since the Federal Reserve was created in 1913, the U.S. dollar has lost more than 96 percent of its purchasing power. The truth is that just a two percent inflation rate will wipe out half of your purchasing power within a single generation. In the chart below, you can clearly see that the beginning of the rapid rise of inflation in the United States coincided with the creation of the Federal Reserve.

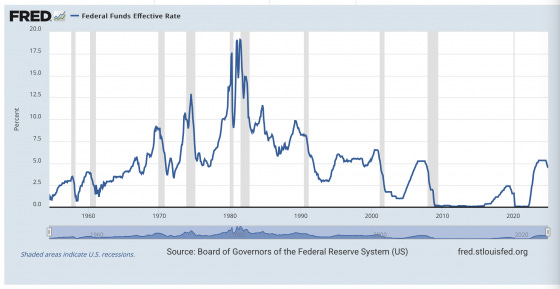

6 – The Federal Reserve manipulates the U.S. economy by setting interest rates. By moving rates higher or lower, the Federal Reserve has the power to create economic growth or to destroy it. They have the power to inflate massive economic bubbles and to pop them. Most Americans believe that our presidents “run the economy”, but the truth is that the Federal Reserve has far more control over the economy than the White House does. As you can see below, every recession since World War II has come after a period of rising interest rates.

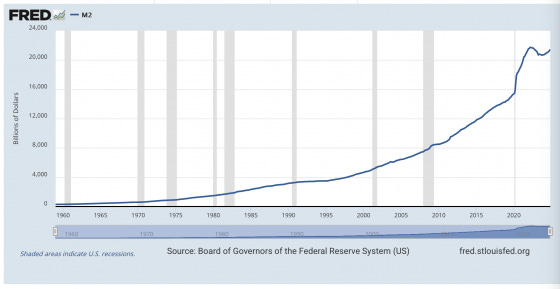

7 – The Federal Reserve also controls the national money supply. They can pump trillions of dollars into the economy or pull trillions of dollars out of the economy without being accountable to anyone. This can have absolutely disastrous consequences. For example, inflation started getting wildly out of control after the Federal Reserve dramatically increased the size of the money supply during the pandemic.

8 – The Federal Reserve has become far, far too powerful. Our financial markets swing up and down whenever a Fed official makes an important statement, and every man, woman and child in the entire country is directly affected by the decisions that the Federal Reserve Board makes. Ron Paul once told MSNBC that he believes that the Federal Reserve has actually become more powerful than Congress…

“The regulations should be on the Federal Reserve. We should have transparency of the Federal Reserve. They can create trillions of dollars to bail out their friends, and we don’t even have any transparency of this. They’re more powerful than the Congress.”

9– The Federal Reserve is dominated by Wall Street and the New York banks. The New York representative is the only permanent member of the Federal Open Market Committee, while the other members rotate. The truth is that the Federal Reserve Bank of New York has always been the most important of the regional Fed banks by far, and in turn the Federal Reserve Bank of New York has always been dominated by Wall Street and the major New York banks.

10– The Federal Reserve has completely eliminated minimum reserve requirements for our banks. Fractional reserve banking has always been a way that the bankers have conned the public, but now they have gotten rid of minimum reserve requirements altogether. This is literally insane.

11 – The Federal Reserve is not accountable to the voters, and Federal Reserve Chair Jerome Powell is flaunting the fact that he cannot even be fired by President Trump…

Federal Reserve Chair Jerome Powell had a clear, direct response when asked during a press conference Thursday if he would step down if asked to do so by President-elect Trump.

“No,” said Powell, whose term as chair ends in 2026.

When asked to elaborate and if he would be legally required to leave, he again said, “No.”

Powell later said it is “not permitted under the law” for the president to fire or demote him or any of the other Fed governors with leadership positions.

Powell’s term will eventually end, but until then he can do whatever he wants.

Shouldn’t we have some way to keep them accountable?

After all, they have an incredible amount of power over us, shouldn’t we have at least a little bit of power over them?

Nobody knows what is really going on inside the Federal Reserve, because we aren’t allowed to see.

Unfortunately, the truth is that they desperately do not want light to be shined on the elaborate “shell game” that they are running.

Have you ever wondered if it was just a coincidence that the personal income tax was implemented just about the same time that the Federal Reserve was created?

Why does the U.S. government have to tax us at all?

Prior to 1913, there was no personal income tax in this country.

If you take a few minutes to stop and think about it, an America where there is no Federal Reserve, no personal income tax and no IRS is not that hard to imagine.

If the U.S. government functioned just fine without all of them at one time, then why couldn’t the U.S. government function just fine without all of them now?

The system that we have now is clearly not working. The Federal Reserve was supposed to guarantee that our system would be perfectly stable, but in reality our system has become much more unstable.

It is time for different thinking. It is time for the U.S. government to take back control of our currency and to take back control of our economy.

For more than a decade, I have been on a crusade to bring the Federal Reserve system to an end, and many others have been pushing for the exact same thing.

Now that we have a new administration in Washington, perhaps they will be open to listening to us.

Michael’s new book entitled “Why” is available in paperback and for the Kindle on Amazon.com, and you can subscribe to his Substack newsletter at michaeltsnyder.substack.com.

About the Author: Michael Snyder’s new book entitled “Why” is available in paperback and for the Kindle on Amazon.com. He has also written eight other books that are available on Amazon.com including “Chaos”, “End Times”, “7 Year Apocalypse”, “Lost Prophecies Of The Future Of America”, “The Beginning Of The End”, and “Living A Life That Really Matters”. When you purchase any of Michael’s books you help to support the work that he is doing. You can also get his articles by email as soon as he publishes them by subscribing to his Substack newsletter. Michael has published thousands of articles on The Economic Collapse Blog, End Of The American Dream and The Most Important News, and he always freely and happily allows others to republish those articles on their own websites. These are such troubled times, and people need hope. John 3:16 tells us about the hope that God has given us through Jesus Christ: “For God so loved the world, that he gave his only begotten Son, that whosoever believeth in him should not perish, but have everlasting life.” If you have not already done so, we strongly urge you to invite Jesus Christ to be your Lord and Savior today.

I think that they've already got their plans in place for how they want all this to work.

They don't ask us, they don't give a hoot about us, they just keep on steamrollering over us.

How' about that for living in a "free country"?😵💫🤮

Whoooop! No CBDC!

Meanwhile, back at the ranch;

Want to play Vax Roulette? 1/200 chance you will die from bird flu jabs.

Former director for the CDC, Dr Robert Redfield, stated in a past interview that he predicts a bird flu pandemic will happen in the future. It is simply a matter of time.

However, rather than offering tools and strategies for individuals to protect themselves, the conversation followed with a focus on experimental vaccines like Audenz, which has been linked to a staggering one in two hundred fatality rate in trials!